Prodigal announces a new class of intelligence for lending operations

Our Series A

The Chief Credit Officer at Fundbox, Kedar Nigudkar, nailed it –

Prodigal’s intelligence alerts us of behaviors we want to minimize at Fundbox, and more importantly, prioritizes our largest opportunities. These insights align our team with customer needs, and deliver winning outcomes.

Consumer debt has increased each of the last 12 years and recently topped $15 trillion. However that is only one part of the story. Look under the hood and customer complaints to the CFPB have increased at a far faster rate. In fact, just since the start of the pandemic, complaints are up more than 50% over the prior twelve months. Lenders are committed to address it but only added manpower to make up for software and system shortcomings.

Just getting started.

We solve this. Prodigal is pioneering a new class of intelligence for lending operations and we are off to a sizzling start.

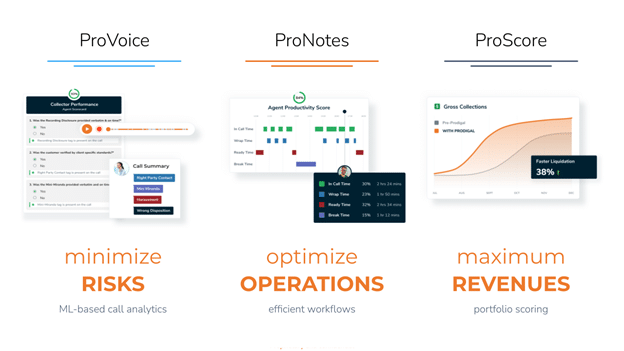

Customers rely on Prodigal to gain insight into customers and to offload repetitive agent tasks to AI. Our decision engine helps lenders maximize returns, optimize operations, and minimize compliance risks, so agents can focus on empathy. In the course of analyzing more than 15M loan accounts to date, Prodigal has helped clients increase productivity by as much as 30% and eliminate 98% of mistakes in compliance, delivering a high ROI and quick payback.

We grew 8x in the last year and serve several dozen lenders & collection agencies .. and we just getting started.

Fueled by top tier investors.

Menlo Ventures is leading our $12M Series A to accelerate the momentum. Croom joins our board as well. Every conversation with Croom, Venky and the Menlo team has rapidly increased our excitement of working together. They have a nuanced understanding of what it takes to build vertical SaaS businesses especially in FinTech. There are clear parallels and lessons to build upon from their investments in Qualia, Indio, Benchling among others. We are thrilled to welcome Menlo to our family.

This is also a great juncture to thank Accel, MGV & Y Combinator for their previously unannounced $2M seed investment and for participation in this round. Dinesh Katiyar at Accel instilled an intense focus on the exact things our customers care most about. This brings our total equity capital raised to $14M.

We have been supported by operators with trailblazing experience in Finance and Technology both. This includes Eric Sager (COO Plaid), Beerud Sheth (CEO Gupshup), Anand Joshi (former VP Global Collections at AmEx), Max Branzburg (VP Coinbase) and many others. Their vote of confidence means a lot.

Make something people want.

This motto resonated with Sangram and me even before we joined Y-Combinator. It identified for us the core value drivers for our industry, otherwise buried under arcane workflows & legacy software. We are now singularly focused on unleashing this core value for lenders(originators), providers of capital (debt buyers) and providers of labor (agencies).

Greg Schubert, President & CEO at Sequium, captures this sentiment

“Prodigal’s technology innovation will transform each aspect of account servicing & collection and we are excited about their current product & roadmap!”

This deep seated customer empathy reflects in every detail of our product and our customers absolutely love us for it. This round turbocharges our growth. We will invest heavily in deepening our product and growing our team.

Let’s do it together.

Our team is my #1 source of energy and joy. Pushing each other to be better every single day helps us grow.

We are expanding our team quickly. We’re currently hiring several key roles in sales, engineering, customer success. Our careers page has a trove of opportunities or just shoot us an email, if you are curious.