The Cost of Bad Credit

Credit scores are crucial to our financial lives, affecting everything from loan approvals to insurance rates. Many people don’t realize the importance of having a good credit score until they face the consequences of bad credit. Whether it’s a declined credit card application or high interest rates on a loan, bad credit can drain your finances and limit your options.

For example, a low credit score can mean much higher mortgage interest rates if you’re trying to buy a home. Over time, these extra costs add up, making it harder to reach your financial goals. Bad credit can also make renting an apartment or getting a job more difficult. The impact of bad credit can shape your entire financial future.

Understanding the effects of bad credit is essential for anyone who wants to maintain good financial health. This Money Chat will explore how bad credit can cost you money and provide practical tips to help you improve your credit score. By the end, you’ll see why keeping a good credit score is important and how you can start taking steps to protect your financial future.

Understanding Credit Scores

What is a Credit Score?

A credit score is a number that reflects how reliable you are when it comes to managing debt. Lenders, like banks and credit card companies, use this score to decide whether to lend you money and at what interest rate. Credit scores range from 300 to 850, with higher scores indicating better credit health and trustworthiness.

How is a Credit Score Calculated?

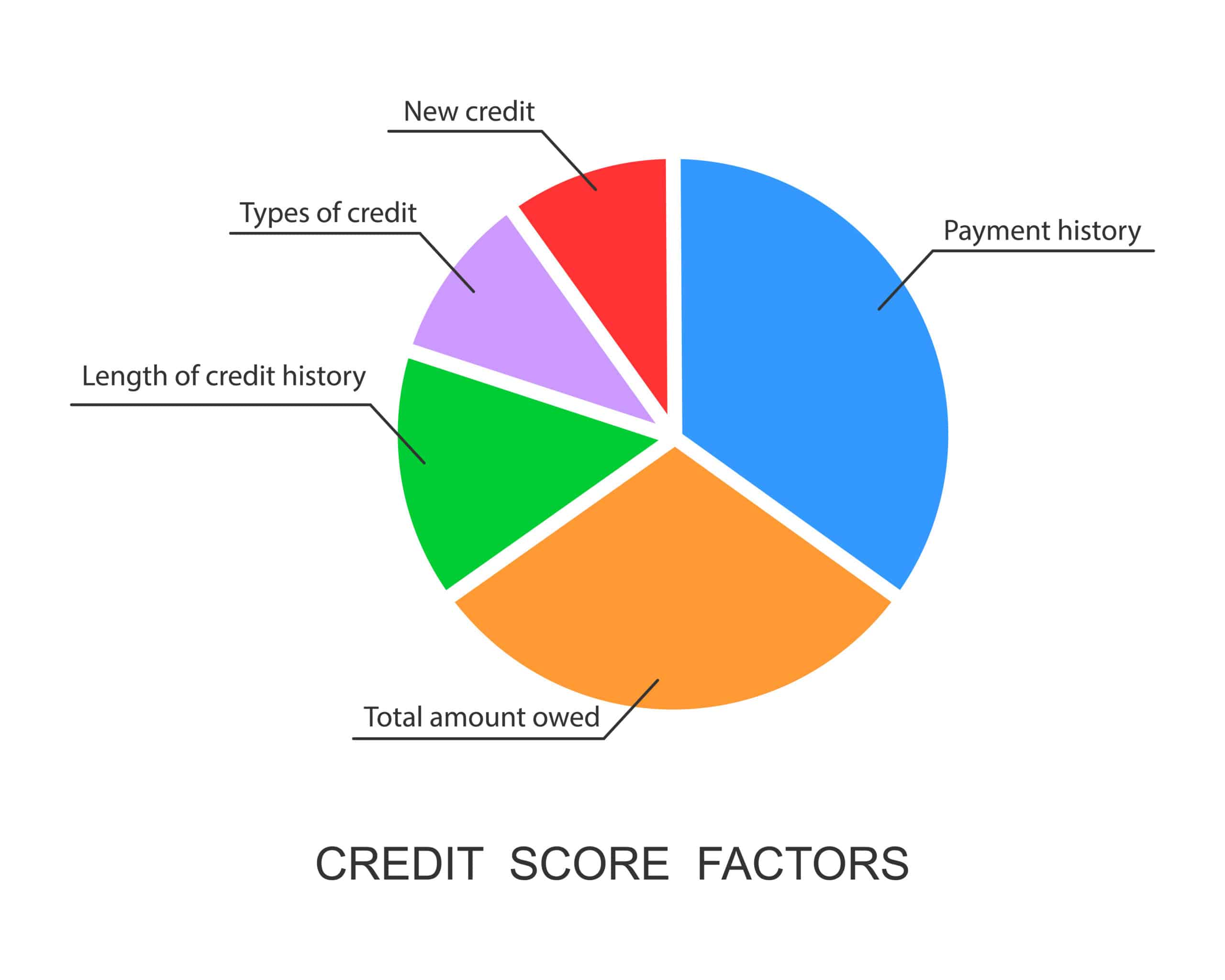

Several factors go into determining your credit score:

- Credit utilization: Percentage of available credit you use. For example, if you have a credit limit of $10,000 and spend $3,000, your credit utilization is 30%. Keeping this number below 30% is best to maintain a good score.

- Payment history: Record of whether you pay your bills on time. Late or missed payments can significantly lower your score, which has the largest impact on your credit score.

- Length of credit history: How long your credit accounts have been open. Generally, the longer your history, the better, as it shows lenders you have more credit management experience.

- New credit: Recent applications for new credit accounts. Opening several new accounts quickly can lower your score because it might indicate financial instability.

Types of credit: The variety of credit accounts you have, such as credit cards, auto loans, and mortgages. A diverse mix can be beneficial because it shows you can responsibly handle different types of credit.

Why is a Good Credit Score Important?

Maintaining a good credit score is crucial for many reasons:

- Lower interest rates

- Better loan approval chances

- Easier renting process

- Enhanced employment opportunities

- Reduced insurance premiums

Great credit can make life easier and more affordable by opening up more opportunities and providing better terms on various financial products. But what happens when you have bad credit?

Direct Financial Costs of Bad Credit

Higher Interest Rates on Loans and Credit Cards

Bad credit means lenders see you as a higher risk and charge higher interest rates to protect themselves. This can lead to paying significantly more over the life of a loan.

Example: You want to purchase a house for $200,000 on a 30-year mortgage. You might get a mortgage with a 4% interest rate if you have good credit; however, with bad credit, the rate could be 8%.

- Total repayment at 4% interest: $343,739.01

- Total repayment at 8% interest: $528,310.49

- Cost difference: $184,571.48

Please note that the total repayment may include other fees, like mortgage insurance premiums, which can further increase the cost.

Increased Insurance Premiums

Credit scores can also affect how much you pay for insurance. Insurers use credit scores to predict the likelihood of you filing a claim.

How do credit scores affect insurance rates? Your auto and home insurance premiums can be significantly higher if you have bad credit. For example, drivers with poor credit can pay over 50% more for car insurance than those with excellent credit. Similarly, homeowners with bad credit might face higher home insurance premiums.

Security Deposits on Utilities and Rentals

Bad credit can lead to extra costs when setting up utilities or renting an apartment. Providers and landlords use credit scores to gauge reliability.

With bad credit, you might have to pay higher security deposits for utilities like electricity, gas, and water. Renting an apartment can also require a larger deposit, sometimes equal to several months’ rent because landlords see you as a higher risk.

These direct financial costs illustrate how bad credit can make everyday expenses more burdensome, leaving you with less money for other financial goals. Let’s take a look at indirect costs.

Indirect Financial Costs of Bad Credit

Limited Access to Credit Products

Lousy credit can restrict your ability to access various credit products. Lenders are less likely to approve loans or credit cards for individuals with poor credit histories. With bad credit, your choices for loans and credit cards become limited. You might only qualify for high-interest, low-limit credit cards or loans with unfavorable terms.

Lower Credit Limits

Even if you get approved for a credit card, bad credit often results in lower credit limits. This limitation can negatively impact your financial flexibility and credit score. This can also lead to higher credit utilization ratios if you use a significant portion of your limit, further hurting your credit score.

For example, if your credit limit is $1,000 and you spend $900, your credit utilization is 90%, which is very high and hurts your credit health.

Higher Costs for Leasing or Renting

Renting is much harder for those with bad credit, as landlords often use credit scores to assess potential tenants. Landlords might require higher security deposits or monthly rent to lessen the perceived risk of those with poor credit. In some cases, you might even be denied the rental altogether, forcing you to look for less desirable and potentially more expensive options.

These indirect financial costs show how bad credit can limit your financial opportunities and make managing your finances more difficult. Understanding these challenges can improve your credit score and avoid these additional costs, but how do they affect you over time?

Long-Term Financial Impact

Achieving Financial Goals Becomes Harder

When you have bad credit, reaching key financial milestones becomes significantly more difficult. A low credit score can make it nearly impossible to get a mortgage. Even if you manage to secure one, the interest rates will be higher, leading to much larger monthly payments and making homeownership a far-off dream.

Entrepreneurs often need loans to start or expand their businesses. Bad credit can mean fewer loan options and higher interest rates, stifling your ability to grow your business.

Limited Employment Opportunities

Your credit score can even impact your career. Many employers, especially in the financial sector, check credit scores during hiring. A poor credit score might be viewed as a sign of financial irresponsibility, potentially costing you a job offer.

Stress and Mental Health Concerns

Bad credit can take a toll on your mental health. Constantly worrying about debt and struggling to make ends meet often leads to high levels of stress and anxiety. The financial stress can cause serious mental health issues such as depression.

Maintaining a good credit score is crucial to a stable and healthy future. Taking steps to improve your credit score now can lead to more opportunities and less stress.

Practical Steps to Improve Your Credit Score

Check Your Credit Report Regularly

Start by making it a habit to check your credit report regularly. You can obtain a free credit report once a year from each of the three major credit bureaus—Equifax, Experian, and TransUnion—through AnnualCreditReport.com.

When you receive your report, check it carefully for any errors or inaccuracies that could negatively impact your score. Look for incorrect personal information, accounts that don’t belong to you, and any wrong negative information. If you find anything incorrect, dispute it immediately.

Pay Bills on Time

Paying your bills on time is critical to maintain and improve your credit score. To ensure you never miss a payment, set up reminders or automatic payments for all your bills, including credit cards, loans, utilities, and rent. Consistent, timely payments will gradually improve your credit score and show lenders that you are a responsible borrower.

Reduce Your Debt

Reducing your debt is essential for a healthier credit score. Start by focusing on paying down your credit card balances and loans. One effective strategy is the snowball method, where you pay off your smallest debts first and then move on to larger ones. This approach can provide quick wins and keep you motivated.

Alternatively, the avalanche method focuses on paying off debts with the highest interest rates first, saving you more money on interest over time. Whichever strategy you choose, the goal is to steadily reduce your debt and improve your credit utilization ratio, positively impacting your credit score.

Avoid New Debt

While working to improve your credit score, avoid taking on new debt. Be cautious with new credit applications, as each application results in a hard inquiry on your credit report. Only apply for new credit when necessary. Instead, focus on managing your existing credit responsibly and paying your current debts.

Get Professional Advice

Seeking professional advice can provide valuable support and guidance. Credit counseling agencies and financial planners offer personalized assistance to fit your financial situation. They can help you create a realistic plan to manage your debt, improve your credit score, and achieve your financial goals. These professionals can also offer strategies for budgeting, saving, and making wise financial decisions that will benefit you in the long term.

By following these practical steps, you can take control of your financial future and work toward a better credit score. Improving your credit opens up more opportunities and provides a solid foundation for achieving your financial goals. It requires patience and diligence, but the rewards of a good credit score are well worth the effort.

A Bad Credit Score Costs More Than You Think

Poor credit can seriously impact your finances. You’ll face higher interest rates on loans and credit cards, meaning you’ll pay more over time. Insurance premiums can increase, and you might need to pay larger security deposits for utilities and rentals. In the long run, it can make achieving big goals like buying a home or starting a business harder. It can also affect job opportunities and increase stress and anxiety.

Improving your credit score is essential. Regularly check your credit report for mistakes, pay your bills on time, work on reducing your debt, avoid taking on new debt, and seek professional advice if needed. These steps can help boost your credit score, opening up more financial opportunities and reducing stress.

Maintaining a good credit score helps you achieve financial goals, improve job prospects, and reduce financial stress. By improving and maintaining your credit score, you can enjoy the benefits of a healthier financial life. Start working on your credit today to ensure a brighter tomorrow.

Free Resources

Here are excellent resources to help you improve your credit score:

- Experian – 24 Ways to Improve Credit

- Equifax – Tips on How to Improve Your Credit Score

- Money Chat – Tips for Building Credit at a Young Age

- Money Chat – How to Check Your Credit Score for Free

Have an idea for a Money Chat topic?

We want to hear from you! If you have a suggestion for a future Money Chat topic, please email us at [email protected].

The information contained in this article is meant to serve as general guidance for consumers and not meant to serve as comprehensive financial advice. For questions about your individual circumstance, finances, or accounts, please contact your creditor(s) and/or financial advisor directly.