The History and Current State of Student Loans

Student loans have been a hot topic in 2024 as the Covid-forbearance program has ended, repayments and interest accrual have resumed, and the “Fresh Start” initiative has now drawn to a close. While disagreement embroils the political climate in debates over federal debt relief and debt cancellation programs, student loan debt and the cost of college tuition in the US have both been climbing to all-time highs.

Without scholarships or public service forgiveness programs, borrowing the money to finance college tuition often comes with a price tag of massive debt for students— an additional financial burden in a challenging time for the cost of living as inflation soars. When borrowers fall behind on payments, options for student loan borrowers that provide relief through student loan refinancing or debt consolidation can be a significant help in a delinquent borrower’s budget.

Current State of Student Loans

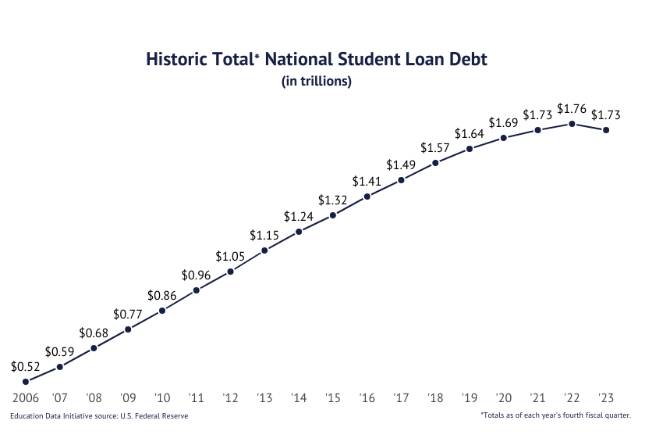

The national total outstanding debt in student loans has increased rapidly the past few years. 2023 saw the first-ever annual decline in student loan debt; however, total student loan debt in the United States totals $1.753 trillion as of July 2024.

Growing Cost of Tuition

Data suggests a variety of reasons for this major increase. One major contributing factor to the rising total of student loan debt is the ballooning cost of tuition. The average price of college has more than doubled in the 21st century. As of May 2024 according to a report from the Education Data Initiative, the average cost of in-state tuition alone is currently $9,750 per year; out-of-state tuition averages $27,457 per year. Many students borrow additional amounts to finance supplies, materials, and housing to attend college.

Increased Borrowing Amount Per Tuition Amount

While tuition has risen, so has borrowing— perhaps even beyond what one might expect in correlation. This is likely due, in part, to the increased cost of living in the last few years. The average student loan debt growth rate outpaces rising tuition costs by 166.9%.

Some analysts theorize that perhaps some students may have borrowed more during the forbearance period, hoping those loans might later be forgiven. Others may have borrowed planning to seek forgiveness through a public service forgiveness program, and later changed career plans. Regardless, a large number of students are financing their education with student loans— over 90% of which are federal loans.

Population of Borrowers

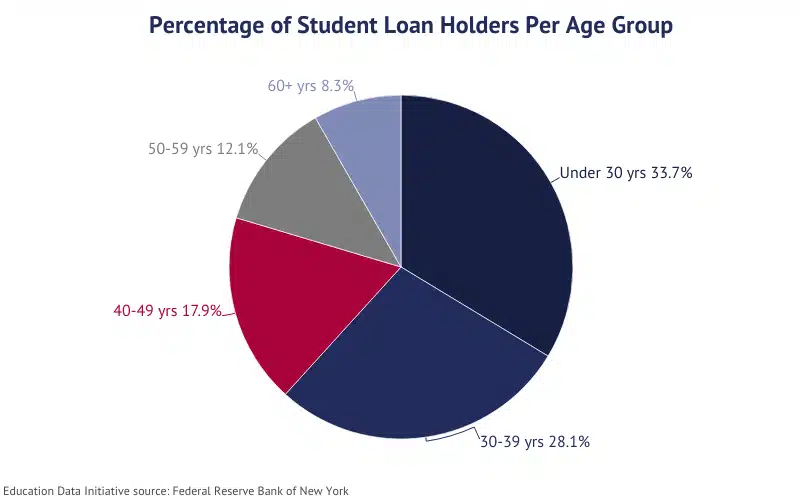

EducationData.org provides a wide range of statistics regarding every aspect of current borrowing trends, including breakdowns of student loan holders by age group. Not surprisingly, most student loan account holders are under 40 years old.

Therefore, the borrower population is typically facing major life expenses associated with their life stages such as first homes, new vehicles, or new families. Adding student loan repayment is another reason why debt refinancing or consolidation can create a significant difference in their day-to-day living.

History of Student Loans

To look back at the evolution of how we got here, the cost of education was stable until the 1970s because no robust loan programs were available. In 1958, the National Defense Student Loan was targeted at mathematics, engineering, or foreign language students. The program name later changed to Perkins Loan and marked a change in the target; Perkins Loans were offered to low-income students with funding matched by the schools.

Federal Family Education Loan Program

These student loans were originally lent by banks through the Federal Family Education Loan Program (FFELP) which began in 1965. FFELP loans were guaranteed by states, and then by the federal government. As a side note, students and parents often misunderstood the “guaranteed” clause to mean they were guaranteed to be approved for the loan, not that the lenders are guaranteed to be repaid if the borrower defaults.

School vs. Student Qualifications

By 2006, rather than simply guaranteeing loans, the government was directly lending in competition with FFELP loans from banks. Some schools moved away from FFELP loans entirely. In response, private lenders adjusted their business models to overcome this new challenge; by 2008, borrower funding shifted from requiring school certification to simply requiring individual student certification.

Students could now get private loan money without school certifications and with funds sent directly to the borrower rather than the school. With this new model, private loans were easier to get and there was no need for parents to apply for federal aid to get them. This came with a new set of pros and cons for student borrowers.

Federal vs. Private

Not all schools qualify for federal loans, but most do. Schools must be designated “Title IV” for students to receive federal loans to attend. Title IV schools cover a broad range of colleges and universities and account for the majority of higher education institutions. If there is a FAFSA (Free Application for Federal Student Aid) form to complete to apply for student aid, then that school is a Title IV institution and has a unique Federal School Code for completing the FAFSA.

If not Title IV (for example— lineman school, pilot school, or other programs directed toward obtaining some type of specific certification), then state student loans or private student loans are often the only financing methods available to those students. While federal loans are provided at a fixed interest rate, private student loans often have a variable interest rate.

Subsidized vs. Unsubsidized

When students or parents/guardians submit a FAFSA to apply for a federal student loan, those with lower income households or parents are more likely to qualify for subsidized loans than those with higher incomes. Subsidized loans do not accumulate interest until after the “grace period” (6 months after the student graduates or exits school). Subsidized loans also do not accrue interest during deferral periods.

0% APR vs In-School Interest Accrual

While some federal student loans are subsidized, private student loans are unsubsidized, and begin accruing interest immediately—during the in-school period, grace period, and post-exit payment deferral periods. These accruals are another reason why some students wind up with challenging payment schedules and rising balances. They may not foresee the issue when they begin school, or life obstacles may arise during the originally planned schedule, delaying the education process and the timeline expected to begin repayment. Meanwhile, high interest rates cause the total balance to grow exponentially.

Recovering Student Loans

By age 30, 37% of associate’s degree holders and 21% of bachelor’s degree holders have been delinquent in student loan payments at least once. Until November 2021, the U.S. Department of Education contracted with private collection agencies to recover defaulted student loans. Today, federal student loans—performing, delinquent, and defaulted— are all centrally managed by a small group of select servicers (private companies like Nelnet) in partnership with Federal Student Aid, an office of the U.S. Department of Education.

How Covid Changed Everything

During the Covid-19 forbearance period, the student mindset changed. Student loan payments disappeared for 3+ years after the federal government put loans on a no-interest hold in May 2020 to help alleviate the economic ramifications of Covid-associated shutdowns.

Some borrowers less in need of the relief used this newfound “wiggle room” that was once directed toward loan payments to buy something else, and the debt gradually slipped from the minds of borrowers to the point of no longer being considered in the budget. During the forbearance period, less than 8% of borrowers continued to pay their loans when not required.

Options for Private Loan Borrowers

42.8 million borrowers have federal student loan debt. Of the $1.753 trillion in total student loan debt, the federal loan balance is $1.620 trillion and accounts for 91.2% of all student loan debt. Private student loans account for the remainder.

Private student loans are not eligible for federal student loan forgiveness programs and are subject to private collection policies, which do not always provide as many options as are offered on federally managed student loans. Options for student loan borrowers such as student loan refinancing can be a significant relief to a delinquent borrower’s budget and the overall cost of repayment.Learn more about the history and state of student loans in this Receivables Info webinar recording with Dan Parks, EVP of Operations at Yrefy, and Andrew Black, General Manager with Yrefy, LLC, a student loan refinancing company:

About Yrēfy

Yrēfy (pronounced “Why refi”) specializes in delinquent and defaulted private loans. Working with Yrefy assists distressed private student loan borrowers in several ways including potential co-borrower release and a 1% – 6% fixed interest rate refinance option for qualified borrowers, regardless of credit score, and improved credit score over the course of the program. Learn more at yrefy.com.