Rebuilding Risk Models in a Student Loan Crisis: Rethinking Creditworthiness in the Face of Rising Delinquencies

By Adam Parks, Founder, Receivables Info

Abstract

Student loan delinquencies have surged to historic highs, with prime and super prime borrowers now defaulting at alarming rates. At the same time, loan origination continues to expand, raising critical questions about the future of credit risk modeling, borrower segmentation, and the structural integrity of student loan systems. This article explores the underlying causes, systemic implications, and urgent recalibrations needed across the financial ecosystem.

A Structural Crisis in Plain Sight

The resurgence of student loan repayment obligations in 2025 was always expected to create friction. But the latest data from TransUnion reveals a far more concerning scenario: as of February 2025, over 20% of 19.6 million student loans are now 90+ days delinquent. More strikingly, a substantial portion of those delinquencies are occurring among borrowers previously classified as prime or even super prime.

“The current credit landscape is broken for student loan borrowers. At Yrefy, we’re not just responding to the crisis—we’re building new models that reflect resilience, accountability, and the potential for a second chance” said Dan Parks with Yrefy.

Traditionally, these consumers have exhibited stable employment, low credit utilization, and long-standing histories of on-time payments. Their transition into default signals not merely borrower stress—but a broader systemic failure in how we assess and predict financial stability.

From Pandemic Pause to Procedural Chaos

This wave of delinquency isn’t simply about borrower behavior; it’s about system strain. The expiration of pandemic-era forbearance programs sent millions of borrowers back into repayment after nearly five years. But rather than a coordinated, transparent transition, the restart was plagued with administrative confusion:

- Misrouted or delayed billing statements

- Unreliable online account access

- Inconsistent communication across servicers

Meanwhile, court challenges and policy reversals surrounding the Biden administration’s SAVE Plan left many borrowers in limbo, unsure of their eligibility or monthly obligations. This blend of technical and regulatory friction undermined borrower confidence, creating conditions where even the most financially responsible were likely to falter.

Prime Borrowers Are No Longer Safe Bets

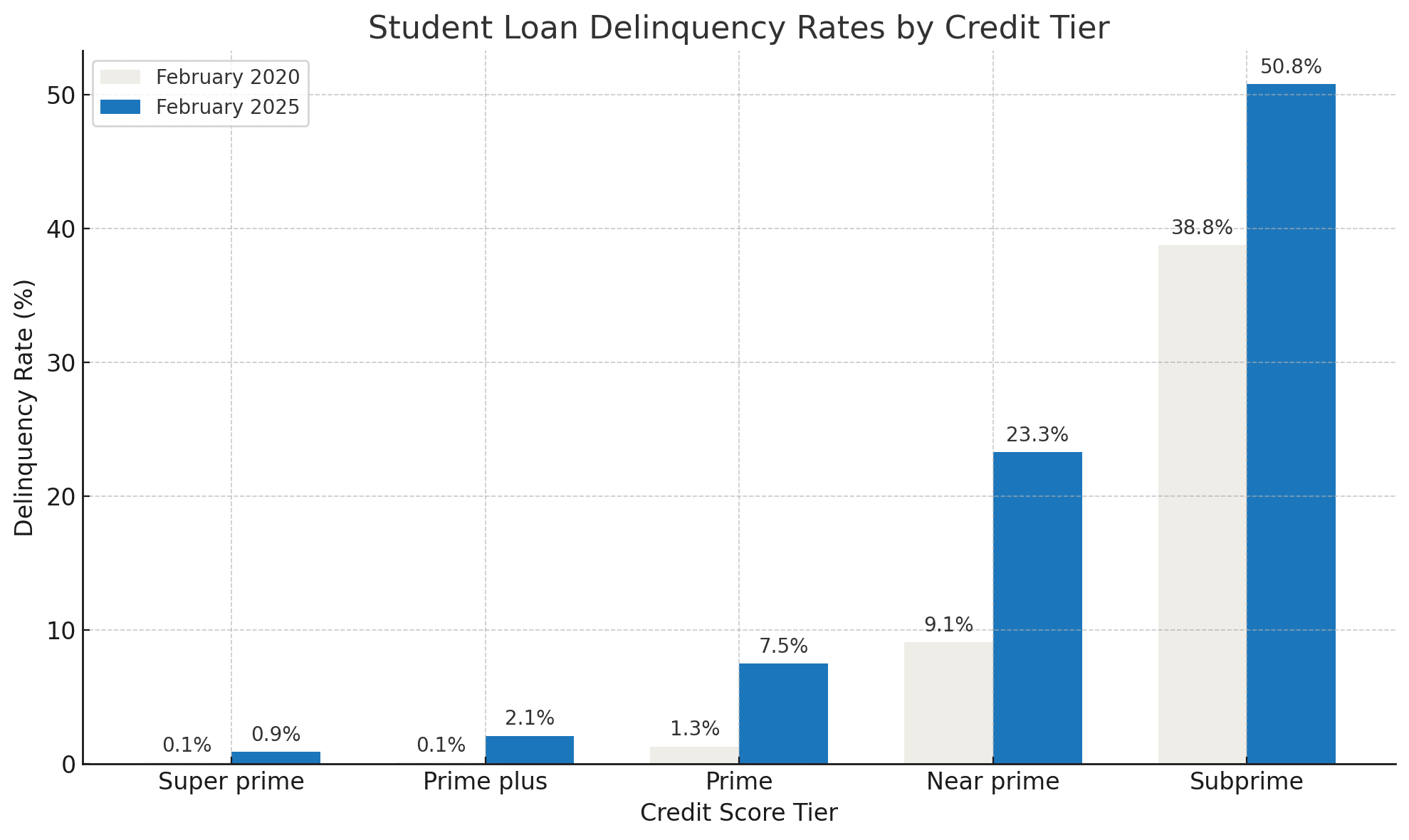

Credit risk frameworks have long used FICO bands as shorthand for borrower quality. But as delinquencies climb among prime-tier borrowers, it’s clear these models need urgent reexamination. TransUnion’s recent stratification of delinquency rates underscores the problem:

- Subprime (FICO <600): 28% delinquency

- Near-prime (601–660): 24% delinquency

- Prime (661–720): 15% delinquency

- Super prime (>720): 11% delinquency

These are not fringe statistics. These are core indicators that high-credit borrowers—those previously considered foundational to repayment certainty—are now defaulting in double digits. In risk modeling terms, this represents a breakdown in predictive validity. What we thought we knew no longer holds.

Risk and Compliance Must Move in Tandem

From a compliance standpoint, this environment demands more than updated disclosure templates or borrower communications. It requires foundational shifts in how we:

- Evaluate repayment capacity

- Define borrower success

- Design systems that anticipate regulatory flux

For operations, this means pressure-testing servicing platforms under volume and stress. For analytics teams, it means revisiting assumptions that treat income, credit score, or educational attainment as static predictors of loan performance. And for compliance leaders, it means building cross-functional partnerships with IT, data science, and risk oversight teams to implement rapid-response frameworks.

We must transition from reactive control to predictive governance.

The Origination Paradox: Growth Amid Distress

Amidst this wave of defaults, another phenomenon is taking shape: student loan origination continues to grow. Federal originations for the 2024–2025 academic year are up by more than 7%, while private lenders continue to market aggressively to new students.

This paradox—soaring delinquencies alongside growing loan volume—raises a pressing question:

Are we underwriting for long-term outcomes or merely short-term access?

Several forces are at play:

- Tuition inflation continues unabated, making borrowing inevitable for many.

- Political narratives around forgiveness may unintentionally encourage risky optimism.

- Many students still lack awareness of alternative aid options.

As a result, the front end of the lending pipeline is expanding even as the back end shows signs of structural collapse. If left unaddressed, this imbalance will create unsustainable pressure for servicers, regulators, and ultimately, taxpayers.

The Need for Proactive Risk Architecture

To address this, we must prioritize a new kind of data-driven foresight. Traditional delinquency triggers must be supplemented with dynamic borrower indicators—real-time changes in employment, digital engagement with servicer platforms, or contextual data from income-driven repayment plans.

Servicing strategies should shift from episodic outreach to continuous engagement, leveraging:

- AI-powered borrower segmentation

- Machine learning-based default prediction

- Multichannel platforms for education, reminders, and support

These aren’t just tech upgrades. They are prerequisites for navigating an increasingly complex and volatile repayment environment.

Rethinking Borrower Resilience

Resilience today isn’t defined by credit score—it’s defined by a borrower’s capacity to navigate instability. That means our models must reflect:

- Behavioral complexity over static thresholds

- Situational triggers over demographic assumptions

- Systemic responsiveness over rigid process adherence

We need to stop asking “Is this borrower risky?” and start asking “Is this system responsive enough to reduce that risk?”

Conclusion: Building Toward a Resilient Repayment Ecosystem

What’s unfolding in the student loan space is not isolated. It’s a preview of how financial systems behave when historical models collide with modern uncertainty. The implications span well beyond student lending into credit cards, auto finance, and even mortgages.

For those of us working in debt collection, receivables management, and fintech, this is not a moment to hold steady. It’s a mandate to rebuild. Risk models, servicing infrastructure, and compliance protocols must evolve together—quickly, transparently, and holistically.

Delinquency among prime borrowers is not just a crack in the surface. It’s a signal that the ground beneath us is shifting. And only those prepared to move with it will avoid falling through.

Author Bio

Adam Parks is the Founder of Receivables Info and a veteran thought leader in the receivables management and fintech industries. With over two decades of experience advising on digital transformation, compliance strategies, and operational excellence, Adam brings a unique systems-level perspective to the challenges facing today’s credit ecosystem.