Understanding the Difference Between Debt Buyers and Collection Agencies

Ever found yourself curious about who’s contacting you regarding a debt you owe? The reality may be more complex than you anticipate.

In this Receivables 101, we’ll break down the differences between debt buyers and collection agencies. By understanding their roles, operational methods, and strategic evolution, you’ll be better equipped to manage your financial obligations.

What is a Debt Buyer?

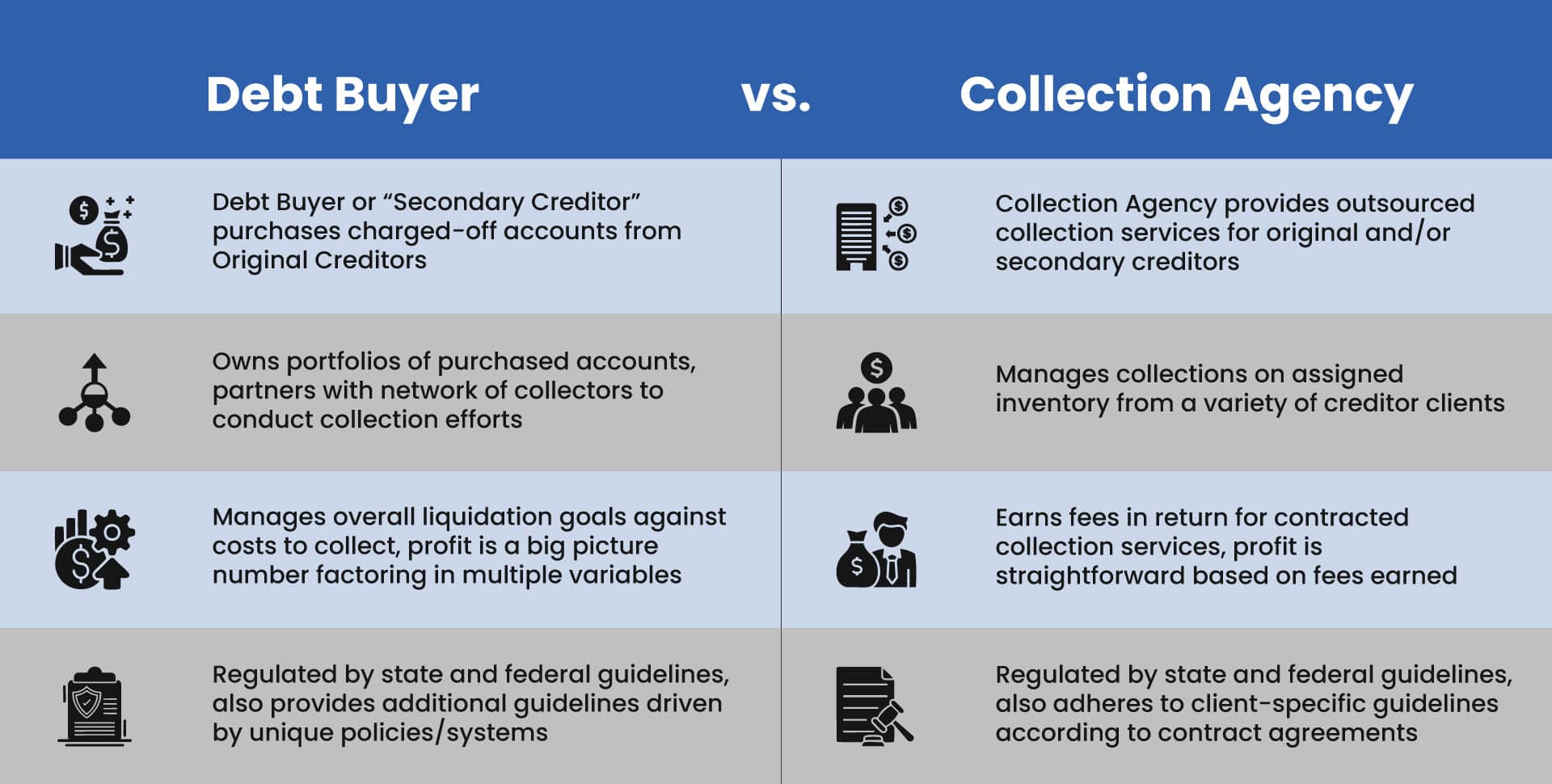

Despite sharing a common objective, the recovery of unpaid debts debt buyers’ and collection agencies’ operational methods, liability, and flexibility vary significantly.

Debt buyers typically purchase unpaid debts directly from original creditors, banks, finance companies, utilities, or other originators of consumer or commercial debt. Once the purchase is completed, the debt buyers assume full ownership of the debt, becoming the new creditor. The ownership status affords debt buyers more control over the recovery process compared to collection agencies or collection law firms, yet it also increases the risk and uncertainty associated with the debt collection process.

- Unlike collection agencies that follow given work standards provided by the creditor, debt buying companies craft their own, within the boundaries of their contract with the originating creditor, federal and state laws.

- Debt buyers operate differently than agencies relying on placements from originating creditors. They may utilize a vast network of collection agencies, law firms, and vendors to assist in asset collection, resembling a hub-and-spoke arrangement.

- Some debt buyers have in-house collections operations for certain types of accounts while outsourcing others.

This key difference also impacts the potential financial return for debt buyers. Unlike collection agencies that earn a fee for their services, debt buyers have to carefully manage their outsourcing partners for liquidation goals balanced against not just the price of the portfolio, but the cost of collecting that portfolio.

What is a Collection Agency?

Collection agencies essentially act as intermediaries in the debt recovery process. They are contracted by the current creditor to pursue outstanding debts. These agencies do not own the debts they’re attempting to collect. Instead, they are assigned these debts, or “placed accounts,” by the original creditor or successor in interest (“secondary creditor”) including debt buyers.

A collector’s role can be seen as an extension of the creditor’s own efforts to recover the debt. They operate under the creditor’s direction, adhering to the guidelines and protocols set out by the creditor. Their principal job is to contact consumers via letters, phone calls, texts, or emails to arrange for repayment. The funds they collect are then returned to the creditor, minus an agreed-upon fee for their services.

(Note: While the role and fee structure of a collection law firm is more complex than that of a collection agency due to legal fees and services, it is important to note that some collection law firms also maintain in-house collections floors that operate similarly to collection agencies.)

Transition from passive to active strategies

Over the years, the financial landscape and its players have been reshaped by evolving practices, regulations, and societal expectations. One such transformative shift within the debt collection industry has been the transition from a passive to a more active responsibility in collection strategies, analytic decisioning, and consumer satisfaction.

Fueled by regulatory modifications and a newfound emphasis on enriching the customer experience, a shift towards more proactive and engaging strategies was initiated. This was not merely a change; it was an industry-wide evolution—a step towards embracing empathy, understanding, and shared responsibility.

Today, debt buyers and collection agencies don’t wait for the conversation to come to them; they initiate it. Communication channels have expanded beyond just the use of phone calls and letter campaigns. Today’s technology enables easy communication by phone, text, email, and other multi-channel and omni-channel solutions.

Consumers are contacted for more than just collecting a debt. An understanding of their individual financial situation is sought to craft a feasible payment plan. This active engagement fosters trust and collaboration, transforming the traditionally stressful experience of debt recovery into a more manageable and considerate process, specifically in the communication methods requested/desired by the consumer,

Empowering consumers through knowledge

In the end, the world of debt collection is about more than collecting owed money. It’s about building relationships, understanding individual financial concerns, and working toward solutions that benefit everyone involved. As we look to the future, it’s clear the debt recovery industry will continue to adapt and innovate, always striving to meet new challenges head-on.

Free Financial Literacy Resources

- Federal Trade Commission (FTC): Authoritative articles and guidelines aimed at helping you understand debt collection, including consumer rights and collector responsibilities.

- Consumer Financial Protection Bureau (CFPB): A great resource for debt-related concerns, the CFPB offers invaluable guidance on navigating interactions with debt collectors.

- National Foundation for Credit Counseling (NFCC): Many free resources, including expert articles and advice, to help individuals manage debt and understand the debt collection process.

- ACA International and Receivables Management Association International (RMAI): These two organizations offer insights into the debt collection industry, focusing on best practices and consumer protection initiatives.

Receivables 101 Takeaway

The debt collection ecosystem is made up of multiple specialized players. Knowing the difference between debt buyers, collection agencies, and collection law firms helps demystify how the industry operates, and empowers you to engage with it more confidently.

To learn more about the terms you’ve learned in this article, or to read more in-depth pieces about the financial industry, please visit our other Receivables Series.