What Is Buy Now, Pay Later (BNPL) and How Does It Work?

If you’ve shopped online in the last few years, you’ve probably seen it: a little box at checkout offering to split your purchase into smaller, interest-free payments. It’s called Buy Now, Pay Later—or BNPL—and it’s quickly become a go-to payment method for millions of consumers.

But what exactly is BNPL, and how does it work? More importantly, is it a smart choice for your finances? Let’s dive in.

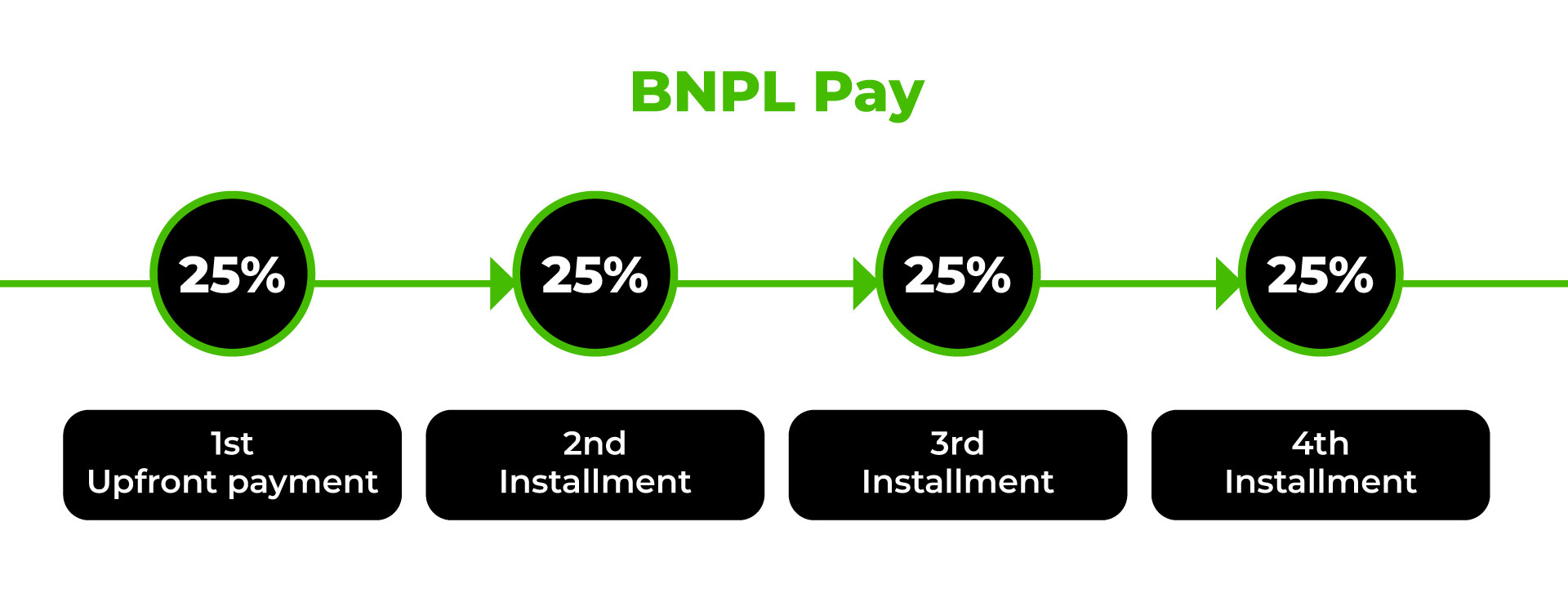

How BNPL Works

At its core, BNPL is a simple concept: instead of paying the full amount upfront, you break the total into a series of smaller payments spread out over time.

The most common plan is called “pay-in-four.” You pay 25% of the purchase price at checkout, then the remaining balance is divided into three equal installments, usually due every two weeks. If you pay on time, many of these plans are interest-free, making them feel like a no-risk option.

Most BNPL providers use a soft credit check that won’t affect your credit score, and approval is typically instant. Payments are linked to your debit card, credit card, or bank account, with autopay ensuring you don’t miss a due date.

While short-term, interest-free plans are the most popular, some companies offer longer-term financing that can stretch over several months or even years. Those longer plans may include interest, so it’s important to read the fine print before committing.

BNPL isn’t just for online shopping anymore. Increasingly, you’ll find it in physical stores, at travel booking sites, and even in service industries like healthcare and home improvement. This expanded availability means the option is now part of everyday consumer decision-making.

Who Is Using BNPL and Why

The BNPL market is growing fast.

Recent data shows that about 50% of U.S. adults have used BNPL in the past year. Usage is especially common among lower- and middle-income households, women, and Black and Hispanic consumers. In fact, 58% of users say it was the only way they could afford a particular purchase, highlighting how BNPL has become a financial bridge for those facing tighter budgets.

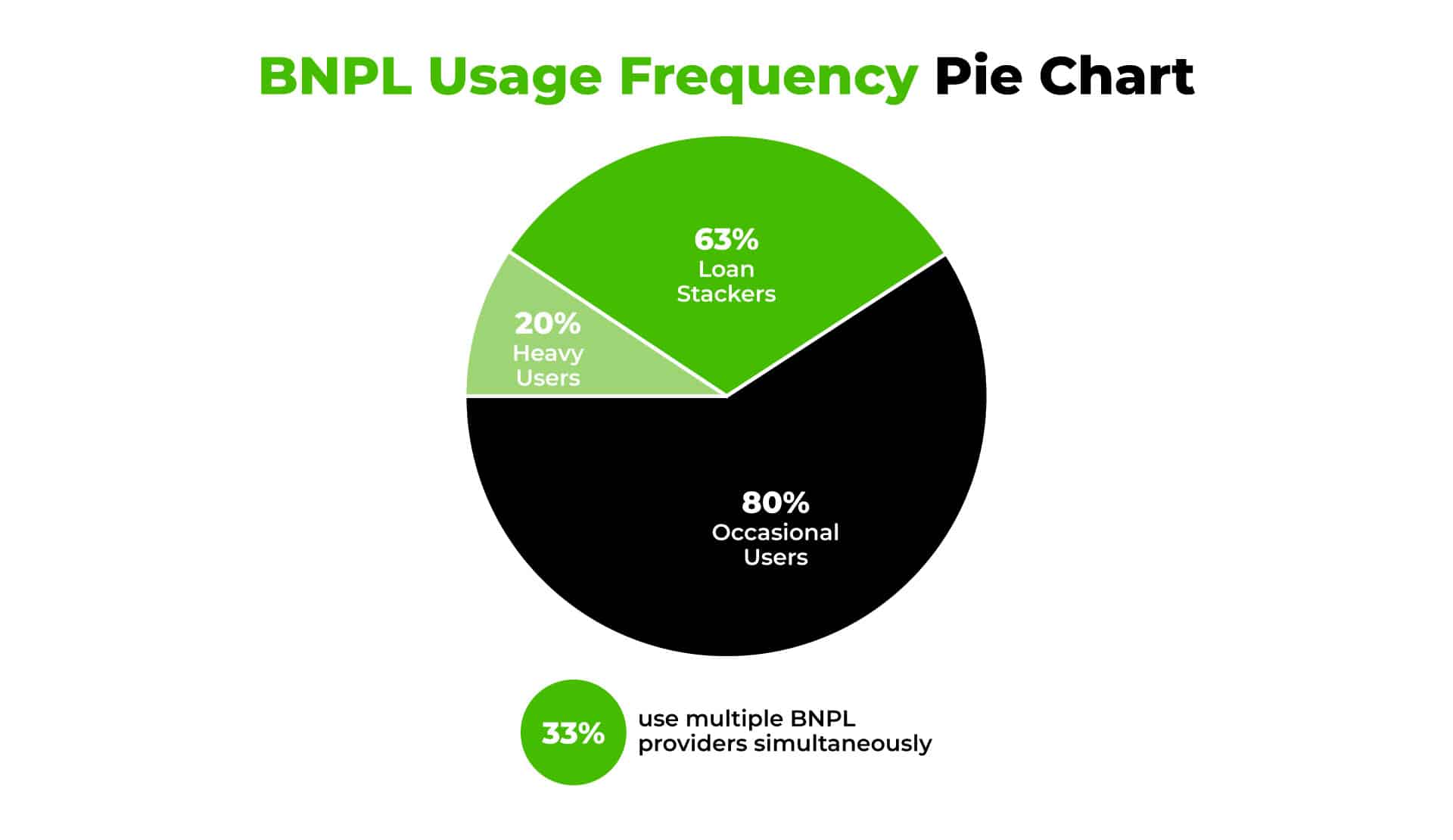

The average BNPL transaction is around $142, with a median of $108. While many people use it occasionally, about 20% of BNPL customers are “heavy users”—taking out more than one BNPL loan each month.

Loan stacking is also common: 63% of users have multiple BNPL plans active at the same time, and one in three works with more than one BNPL provider. For these consumers, BNPL isn’t just a one-off convenience—it’s a recurring part of their spending habits.

Beyond the interest-free appeal, BNPL offers a feeling of control. Breaking a payment into smaller amounts can make large purchases seem less intimidating. For some, it’s about flexibility; for others, it’s about making ends meet without turning to high-interest credit cards.

The Benefits of BNPL

When used responsibly, BNPL can be a practical budgeting tool. Here are some of the key advantages:

- Interest-free payments on most pay-in-four plans if payments are made on time.

- Accessible approval process with softer credit checks, opening the option to more consumers.

- Predictable repayment schedules that make budgeting easier.

- Automated payments to help avoid missed due dates.

- Quick purchasing power for time-sensitive needs like replacing an essential item or taking advantage of a limited-time deal.

The Risks You Need to Know About Using BNPL

The ease of BNPL also comes with potential pitfalls. Common concerns include:

- Late payments: About 24% of users report paying late, and more than half of them face extra fees.

- Overspending temptation: Smaller payments can disguise the true cost and encourage buying more than you can afford.

- Loan stacking: Having multiple active BNPL plans can create budget strain.

- Evolving credit reporting: Historically invisible to credit bureaus, BNPL loans are beginning to be reported, which means missed payments could impact your credit score.

- Long-term financing costs: Extended-term BNPL plans may include interest and fees, making them less cost-effective.

BNPL vs. Credit Cards

BNPL and credit cards both allow you to pay over time, but they operate differently. BNPL is structured, with fixed payment amounts and clear end dates. Most plans avoid interest if you pay on time, but they offer limited flexibility once the schedule is set. Credit cards, on the other hand, provide revolving credit—you can carry a balance from month to month, pay more or less than the full amount, and use the same account for multiple purchases. However, interest rates can be high if you don’t pay your balance in full.

The choice often comes down to your goals. If you want a predictable, short-term plan without interest, BNPL may be a better fit. If you’re looking to build credit history and can manage balances responsibly, a credit card might offer more long-term benefits.

How to Use BNPL Wisely

If you decide BNPL fits your needs, the key is to approach it with the same discipline you’d use for any form of credit. Start by setting a clear budget before you commit to a plan. Ask yourself if you could still afford the purchase without BNPL—if the answer is no, think twice.

Limit yourself to one BNPL plan at a time, or at least keep the number of active plans manageable. Always opt for autopay to avoid late fees, but make sure the linked account has enough funds to cover the charges. Finally, read the terms carefully so you understand any fees, interest charges, or credit reporting implications.

BNPL can be a helpful tool, but like any tool, it works best in the right hands and under the right circumstances. Used thoughtfully, it can help you manage your cash flow and avoid debt traps. Used recklessly, it can create financial stress.

The Bottom Line

Buy Now, Pay Later offers convenience, flexibility, and often interest-free financing, making it a tempting choice for consumers. But the ease of use comes with responsibilities—and potential risks. By understanding how it works, recognizing the benefits and drawbacks, and following smart use practices, you can make BNPL work for you instead of against you.

Have an idea for a Money Chat topic?

We want to hear from you! If you have a suggestion for a future Money Chat topic, contact Receivables Info.

The information contained in this article is meant to serve as general guidance for consumers and not meant to serve as comprehensive financial advice. For questions about your individual circumstance, finances, or accounts, please contact your creditor(s) and/or financial advisor directly.

Thank you to our sponsor, Plaza Services, LLC

Plaza Services, LLC is an accounts receivable portfolio investment firm founded in 2013 and headquartered in Atlanta, GA. Plaza Services manages and services acquired accounts while maintaining the highest ethical and legal standards. Plaza is committed to providing a positive experience for consumers while providing creditors with maximum value for receivables portfolios in a fully compliant manner. As an RMAI Certified Debt Buyer, Plaza Services delivers quick portfolio evaluations and seamless transaction execution with clear accountability after the sale, making us the perfect partner for creditors. Plaza Services partners with a very select group of vetted partners in the auto loan, fintech, consumer loan, and consumer credit spaces, among other types of creditors, in order to improve cash flow to the bottom line and mitigate financial losses caused by overdue assets through the acquisition and recovery of distressed and dormant receivables portfolios.